The Year of The Curve Flattener

Reviewing the flattening of the UST yield curve, the press conference and SEP projections.

Hey crew,

Good to be back.

One of the MMH members gifted me what might be one of the best gifts yet.

My own name plaque for MMH.

It’s the small things that mean the most.

I’m back at my desk, decrypting the Fed press conference and the SEP document. So let’s dive into this report.

As always lend me your attention:

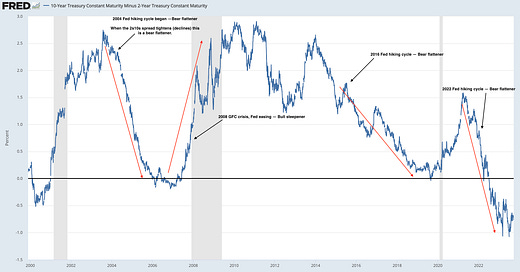

The Bear Flattener

I’ve been reading into FI (fixed income) a lot more than usual. I could credit that to the importance it has in FX markets, especially with yields being a large decider of currency markets. As we know, yields are driven by interest rates, so if one were to simplify what component of macro and markets moves a currency we can pin it down to yields and interest rate differentials.

For most of you, the term ‘bear flattener’ will be an elusive term with a lot of mystery surrounding its meaning. The shape and movement of the yield curve plays a significant role within macro. So before we dive into the ramifications of the Fed meeting, let me break this term down in simple terms for you all.

When looking at the yield curve of any economy, be that the US (UST yield curve), or the UK (Gilt yield curve) you have 4 different ways the yield curve moves. For simplicity reasons, we’ll focus only on one today which is relevant to where we are now.

A bear flattener occurs when short-term interest rates rise faster than long-term interest rates. For example, the 2-year Treasury yield may rise faster than the 10-year Treasury yield. Bear flatteners typically occur when the Federal Reserve is raising interest rates to combat inflation. This is because investors expect higher rates to lead to lower long-term economic growth and inflation expectations.

Historically, bear flatteners and bull steepeners have occurred when the spread between the 2-year and 10-year Treasury yields has narrowed (flattener) or widened (steepener), respectively. For example, the 2008 Global Financial Crisis was an example of a bull steepener in the 2s10s. As the 2s10s yield curve moves toward 0.0, the yield on the 2-year Treasury note is increasing more than the yield on the 10-year Treasury note, resulting in a tighter spread between the two. Since 2022, the US yield curve has been in a bear flattener regime, with the 2-year Treasury yield skyrocketing to 17-year highs and remaining inverted against the 10-year Treasury yield for over 12 months.

To know whether the yield curve is flattening you need to chose two maturities along the yield curve, (2s10s, 5s30s, 3m10s) and measure the change in spread over a set time period. So we’re going to take a look at the 2s10s curve once again at the start of the year and yesterday’s conference.

Let’s make this simple.

The blue line in the attached chart represents the yield curve as of September 20, 2023, while the red line represents the yield curve at the start of the year. Since the start of the year, the 2-year yield has risen 71bps, while the 10-year yield has only risen 47bps. This is known as a bear flattener, which occurs when short-term interest rates rise faster than long-term interest rates. This is expected, as the Fed has raised short-term rates over 100bps so far in 2023. The chart also shows a drastic steepening in yields in the shorter end, such as the 3-month T-bill, which further confirms the bear flattener of the US yield curve.

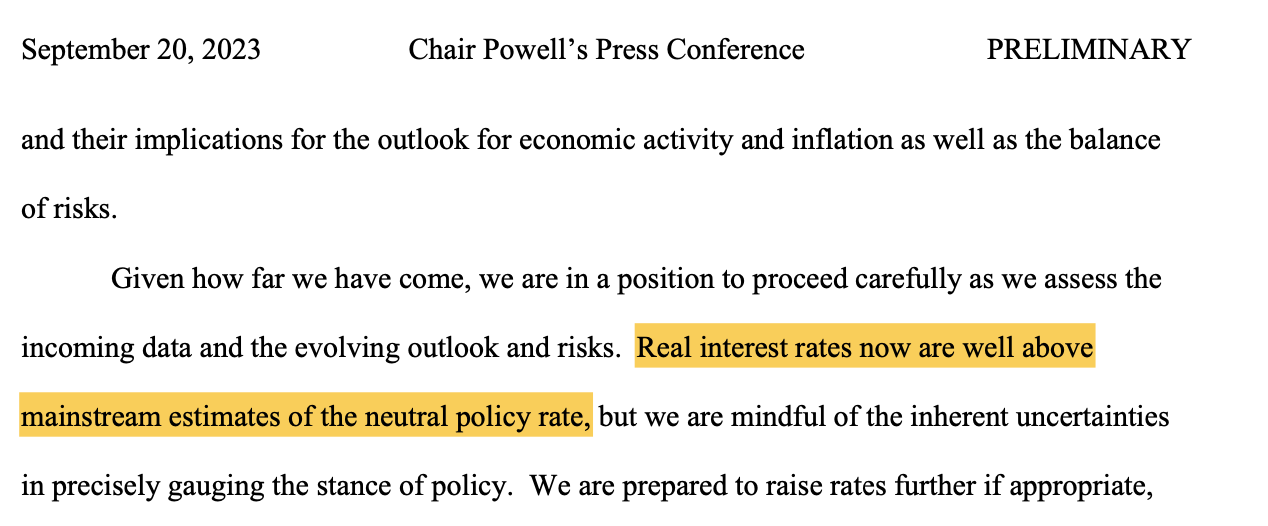

The overall consensus from the Fed meeting was a hawkish Powell reinforcing higher for longer. Analysing the transcript two main themes were brought to life.

The labour market

Resilience of the U.S economy and consumer

During the press conference Jay Powell mentioned the word ‘rebalancing’ six times, when making forward looking comments on the labour market.

“FOMC participants expect the rebalancing in the labor market to continue, easing upward pressures on inflation.”

— Jay Powell, Fed Chair

As soon as Jay Powell referenced an easing in the labour market, the SEP (summary of economic projections) document was the first material I read.

The meaning of ‘rebalancing in the labor market’ simply refers to further loosening and job losses, putting the job market back in equilibrium as we’ve seen US unemployment hit record lows. Comparing June’s projection to September’s projection the Fed expect strong growth to carry forward into 2024 and the unemployment rate to rise 0.3% vs 0.4% forcast vs June.

But here’s why a strong economy and resilient labour market is a double edged sword.

“Stronger econoimc activity means we have to do more with rates”

— Jay Powell, Fed Chair

That line right there explains the 50bps in interest rate cuts removed from 2024. In June’s SEP forecast rates were forcasted to decline 100bps during 2024, now, that figure is 50bps.

Removing 50bps in cuts means higher for longer, but more importantly, higher real rates. Real rates are simply the true interest rate in the economy after subtracting inflation, giving the true interest rate in an economy. Based on June’s projections, real rates through 2024 were 2.1%, after September’s release real rates have increased 50bps to 2.6%.

Attention now turns to November, with one more rate hike expected. As we approach the end of the year, we draw closer to significant regime changes in the macroeconomy and potential inflection points like the one we experienced in October 2022. This presents opportunities, as well as a change in the shape of the yield curve, which I will cover once we begin to see long-end yields rally faster than short-end yields as the Fed begins cuts from 2024.

To sum up this report, the Federal Reserve's September 2023 meeting was rather hawkish along with the SEP projections and Powell reaffirming a commitment to higher interest rates for longer. The Fed expects the strong economy and resilient labor market to continue into 2024, but this is a double-edged sword, as it also means that the Fed will need to do more with rates to bring inflation down. As a result, the Fed has removed 50bps in interest rate cuts from its 2024 projections, meaning that real rates are expected to be higher for longer.

There’s key macro plays that can be made as we move closer to what may be a regime shift, so I’ll be sure to provide detailed insight on my views, such as my short oil view from last week but in wider instruments across markets.

As always, I appreciate you guys, I hope you’ve enjoyed!