Another week down!

It was a central bank bonanza for markets, but the spotlight at the moment is centered elsewhere—yes, you guessed it, the Middle East conflict.

What began as a “wait & see” stance has turned into active engagement. Trump has taken direct steps toward supporting Israel’s defense, even as Powell continues to navigate the crosscurrents of inflation headwinds and labor strain.

With quite unique moves taking place in FX amid policy signaling with each turn, let’s unpack main drivers from mere headlines…

Global Markets

SNB: Zero to Hero

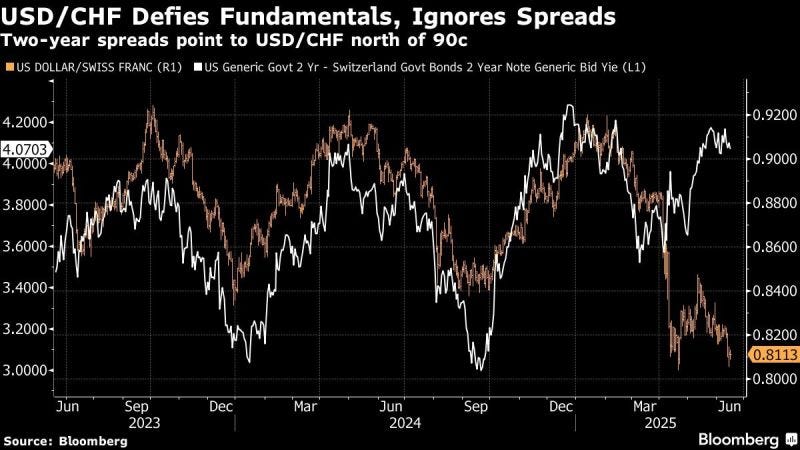

The Switzerland National Bank stood out in the tapes this week as its key rate was cut to 0%, a 25bps reduction. Deflation theme, 0% deposit rate, yet the Swiss franc is currently blazing, up c.11% against the greenback YTD.

Dovish signalling wasn’t enough to deter the Franc rally. So whats going on…

The best way to describe this situation is the CHF currently ‘suffering from success’. The safe haven accrued to this currency continues to kick in as we navigate market volatility. From tariffs to conflicts, this endless spawn of uncertainties continues to aid capital flows seeking stability into the Franc. The chart above mirrors this reality to the dot, where positive yields alone are not a guarantee of currency appreciation.

No doubt the SNB are no strangers to navigating these murky waters. Figure 2 summarizes the 2011–15 era, where the euro debt crisis forced the SNB to soft-commit to maintaining a peg at 1.2 only to later abandon the 1.2 floor and phase out a float.

‘ALL options remain on the table, including negative interest rates and foreign exchange market interventions…'

SNB Chair Martin Schlegel

It’s 2025, and negative era whispers are starting to surface. During the policy meeting, it was made clear that if the economic situation worsens, intervention is possible however that bar would need to high, Chair Schlegel explictly pointed out leaving rates to reprices c.10bps out of terminal rate. Six cuts deep, and it's clear traditional monetary policies have taken a back seat—more so, they might end up being their own detriment. The Swiss are heavily dependent on exports, running a strong trade surplus with the rest of the world, most notably almost a $10B deficit with the US, mix the trade uncertanity with a strong Franc and export value has declined more than 40% since March. A strong currency hurts, but at the same time, it's best to tread carefully. The reciprocal window is fast approaching. Pharma tariffs remains an option Trump teases on, and the Swiss could stand to be punished as the White House has made clear its intent to penalize trading partners deemed to explore currency manipulation, with Trump threatening tariffs on pharma are “coming very soon.”

The SNB is oscillating between two painful options: a possibility of a negative rates terriority in the presence of geoplotical risk, that keeps the Franc firm re-echoing the deflationary chims, or a forceful intervention that might draw fire from global counterparts.

For FX I entertained the idea of playing into the CHF as a funding ccy expressing views via Long EURCHF as the 2 weeks could potentially open the path for diplomatic talks, well to hell with that idea (at least for now). I’ll be sidelined on this move accesing how markets view a possible response from Iran, which according to their domestic media seem commited to the plot with response from Khamenei showing no sign of backing off.

How this situation develops remains crucial…

More central bank moves, noteably was BoE which met bank rate unchaged at 4.25% on a 6-3 vote in favour of a hold. We contiinue to think the path to the bank resuming its cutting cycle will follow a slow grind lower as the committe weighs both inflation pressures and detriorating growth headwinds. In the absence of the BoE unwillingly to highlight a clear path or robust scneario analysis on possible reaction fuction to both mandate we should see in coming week domestic macro output amplified as traders pile on their various narrative. Next weeks focus for traders would be PMI figures which would inform us more on the economy’s stability, a normalisation away from front running tariff fears.

Outside that, the BoJ is still mute on the path of monetary policy, with a solid 8-1 vote to maintain current policy rate. The real news was a reduction in tapering JGB purchase to ¥200B from ¥400B absorbing pressure from ghost demand that sent yielder higher across the curve. More on Yen positioning later…

The Dot & More….

If you didn’t tune in to the conference, guaranteed you didn’t miss much. The Committee is less of guidance and more at the mercy of data. I guess they kinda work hand in hand, and the plethora of possible scenario outcomes makes it harder. Moving along, on a serious note, props to Chair Powell, he’s managed to remain on the fence, throwing a bone to both doves and bears. But despite Trump going to war with JP, we do think, on the margin he leans toward the doves.

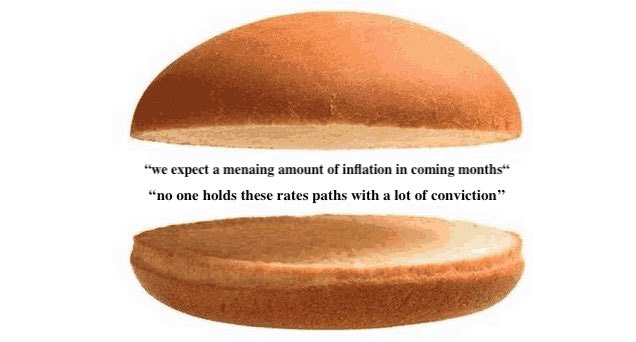

This chart captures the Fed policy event last week. The Committee formed a fist, but JP softened the blow.

Key Takeaways

SEP

Growth down, inflation up

9/19 members opted for 2 cuts, with close margins (7 opting for no cuts)

Longer-run EFFR revised higher; 25bps reduction of 2026 terminal rates.

The Powell Nothingburger

In a nutshell, the Fed’s reaction function remains very much ready, but at the moment they don’t know exactly what they’re to reacting to. The first sight of the projections highlights a stagflationary narrative, painting a Fed potentially committed to holding up the fort against possible price hikes washing ashore, yet conveniently maintaining optionality to cut 50bps at the sight of growth deterioration. I’d be the first supporter of a Fed staying the course, equities bulleting higher every other week, still deemed decent payroll figures amidst large-scale immigration shifts— but rather the event screamed whispers of doves. I get it, we received one less cut for 2026, but honestly, I wouldn’t put much weight on it. It’s not the first rodeo. At the June 2023 FOMC meeting, the median dot for 2024 was marked down from 75bps of anticipated cuts to just 25bps only for it to be revised sharply upward to 100bps by September. In the end, that full 100bps was delivered. A clear illustration of how quickly the Fed’s reaction function can pivot when confronted with shifting macro realities.

Powell hangs his boots in 8 months, and odds are we get a dovish Chair or at the least, less hawkish, is high. When Fed governors like Waller take the mic making justification for the Fed to begin easing, Markets lend ears and apparently don’t question the Fed's credibility or lose face. RenMac via X tells the story clearly:

Dear Trump, nominate Waller now. What Trump needs are people that can intellectually defend arguments for dovish monetary policy when times demand it and do so in a way that the FOMC staff can respect. Waller is that person.

Neil Dutta

while in the meantime, it’s a battle of which gives first labour market or inflation:

Inflation:

Chair Powell remark on inflation: ‘We hadn't expected the impacts of tariffs to show up much by now and they haven't. And we will see the extent to which they do over coming months.’

While Wall Street analysts continue to debate the timeline for tariff increases, figures like the retail sales control group rate ticked higher coming out 50bps higher at 0.4% from the previous month. Interestingly enough this metric excludes volatile sectors like energy and food which the disinflationary trend has benefitted from the former. A print like this confirms China is not, in fact, eating the cost like the President portrays at the moment.

Labour:

Chair Powell remark on labour data: ‘...any worrying trends in the labor data are still low-grade, and soft May CPI data isn’t enough to declare tariff- related inflation risks dead.’

With still positive 100k plus figures on payrolls, the labor market appears non-threating at least JP thinks so, attributing it to supply-demand factors as new immigration policy working its way through the economy. Employer reluctance to new hires is, at the moment, putting pressure on claims, elevating to levels not seen since September last year that warranted a total reprice of rates on fear of a growth drag causing Powell to signal a dovish shift at Jackson Hole.

Over across the Pacific, the G7 summit proved more of a photo-op rather than yielding anything materially tangible. I had my hopes up for a meaningful trade development between Akazawa and Trump and only got an early event from the latter—verbal volleys thrown at Macron. OK, maybe not that uneventful, still between the too-chicken-to-commit BoJ, and a U.S. Dollar finding marginal flows amidst a Fed signaling a longer pause and heightened geopolitics. Pain trade for USDJPY seems high, taking into account paying to short a carry, it sucks—however price action still unable to breach April liberation daY high is an encouraging sign. Longer-term macro outlook still looks promising (we got core inflation coming hotter last week at 3.7%), but the tariff uncertainty and possible conflict escalation say otherwise.

Macro Trade Idea

Short GBPMXN

The committe acknowleged weakened growth indicating clearer signs that a margin of slack has opened up in its labour market. They however remained cautions in their narrative, stating failure to see immediate catalyst for aggressive easing making known their view on risk of inflation surging sponsored by an overly easing policy shift feeding into higher cosumer prices. Given a scneario where growth outlook remains benign (although revised a tard higher benefiting from inulated tariff shocks ) a tactical long against USD (ie short GBPUSD) could pose beneficial in the midst of hightened geopolitical risk. however a more constrictive view favours cyclically higher cable, aside broader dollar deversification view, forecast rates compared to the USD are more attractive.

In this light, I think the most optimal way to express a bearish pound view is through funding currency for high yields in EM markets. Mexican Peso would be an excellent selection here.

Long EURCAD & USDCAD (tactical)

The CAD stands out as the common cross here amid USD strength and rising EUR cyclical momentum, particularly with the former following now confirmed US direct involvemet in the ME region, targetting Iran’s nuclear base. If markets truly fear things esclating here a gap up Sunday open on risk-off on the Lonnie wouldn’t come as a suprise and in my opinion retracement filling them should be bought. While over in the Eurobloc, this week Europe gears up for a pivotal week, with Germany’s budget proposal and a defense summit in focus, likely to channel 5% of GDP into infrastructure and military investment. The CAD has largerly enjoyed some recovery since the liberation mess, benfiting from the USD demise and beats in retail spend last week, however some key things to note.

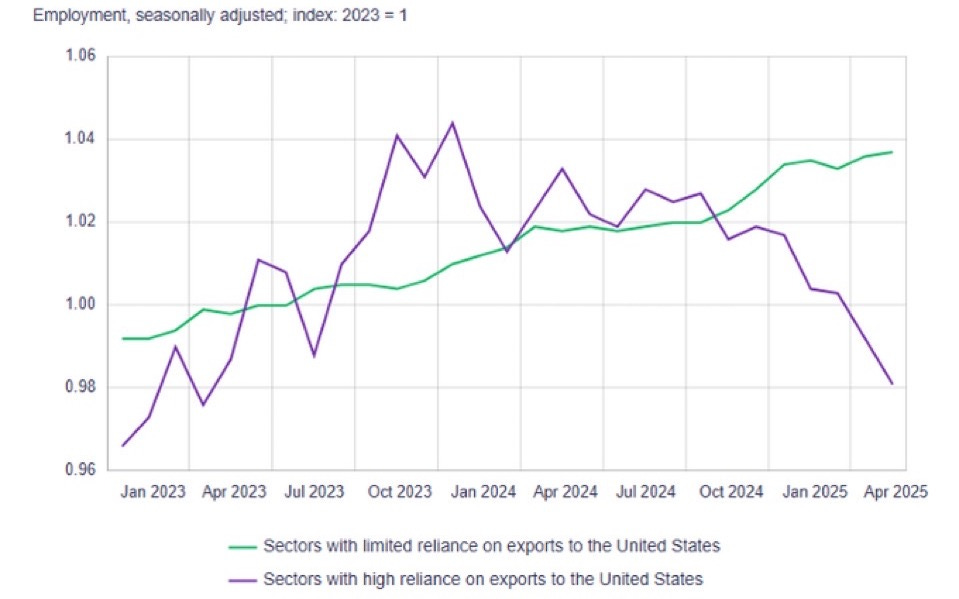

Canada continues to bear the brunt of tariff spillovers & suprisely they are in fact eating the ‘trump tariff cost’ the BoC’s latest Business Outlook Survey for May confirms that exporters are cutting prices to stay competitive effectively absorbing part of the tariff cost.

Labour data still remains under pressure, highest level since 2016 ex-Covid. Export critical sectors laying off more workforce.

In the near term, the dollar retains a tactical bid IMO from heightened geopolitical risk and a data-dependent Fed still masquerading as ‘hawkish’ in the absence of hard growth peel data.

That’s a wrap guys.

Please if you find this reports helpful show support by sharing with friends and family, THANK YOU!