The Last Hike. Signed & Sealed

Reviewing the current global macro landscape and what this new season of zero rate hikes will look like for financial markets

Hey everyone,

Picture this.

It’s chest day in the gym.

Load up some heavy dumbells, I’m feeling weak, but hey, let’s go for four anyway.

We smash right past four reps with ease. Complete mastery, and now I’m having the time of my life.

I’m glad I get to share these moments with you.

Anyways, it’s been a minute since doing a macro snapshot of where we are and what’s happening.

A soft CPI print, risk assets still fairing well YTD returns and Fed implied rate pricing in some cuts.

As always lend me your attention:

Good Bye Inflation…

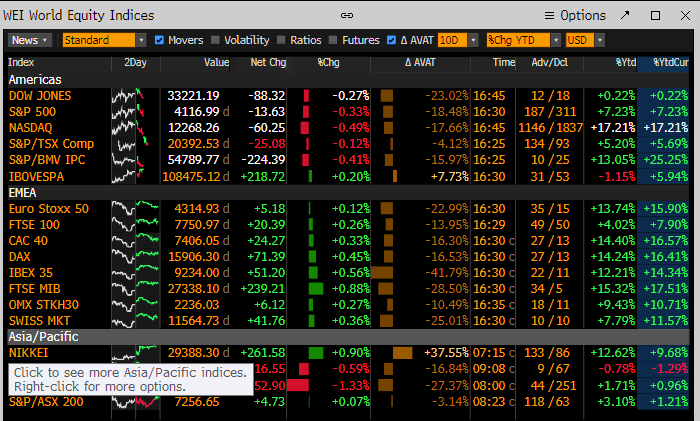

As we stand this is how global markets are positioned.

IR* = Interest rates

RoW = Rest of World

Not so bad if you ask me?

Considering the fact that we’re currently going through a regional banking crisis with JPM acquiring FRC (First Republic Bank) and other smaller banks rushing to raise cash to boost investor sentiment on their perceived resiliency.

JPM will inherit FRC’s $173b loan book and roughly $30b in securities and c.$92b of deposits for roughly $10b, there’s always a winner in crises.

Wednesday we got news of U.S CPI YoY and boy was a soft print needed to set in stone the Fed pause and potential pivot!

4.9% was the magic number. Expectations were for CPI YoY to hold flat at 5.0%, the same as March’s figure but we saw a 0.1% decline for the top-line figure which means everything to investors and the Fed.

“Once inflation gets above 5%, it’s never come down unless the Fed Funds rate is higher than the CPI”

This was taken from an interview with Stanley Druckenmiller, a world-renowned hedge fund manager back in June of 2022! This was back when Fed funds were 1.75% and inflation was 8%.

Those words are weren’t far from the truth, in fact, you can see that now for the first time, real rates in the U.S are positive with interest rates being higher than CPI.

For the first time since 2019, CPI is back below Federal funds rates; to the Fed, this is probably the biggest piece of positive data that has come to them in over 12 months, which now puts the Fed back in control of governing monetary policy appropriately, although core CPI as I have expressed many times still remains stick unchanged at 5.5% which is why the Fed is looking for signs of weakening within an extremely tight labour market.

It’s also worth mentioning that once inflation gets above 5%, it’s never been tamed without a recession. So unless the Fed plan on supporting the economy once more this year with QE or some other liquidity support it’s set in stone that the next macro stop for the U.S is a recession.

But that’s all we’ve heard in the news, I’m sure you want to know what this means for Fed funds and markets (FX, Equities etc) over the near-mid term.

Here’s a chart of Fed Funds Futures showing the implied overnight rate and the number of hikes/cuts currently being priced into the economy. Now for some content, the implied overnight rate represents the interest rate that banks and financial institutions expect to charge each other for overnight loans (short-term loans financial institutions engage in to meet liquidity, reserve and other requirements).

On the left-hand-side, you’ll notice the OIS (overnight index swaps) for the Euro Zone, GB and other EU countries, you can see that the expectations for the next BOE meeting on the 6th of June 2023 the institutions are pricing in overnight borrowing rates to be higher in anticipation of a BOE rate hike.

But back to the U.S, you can see that not only one cut but four cuts are being priced in by this futures instrument. Now does this mean that we should forget everything and expect cuts starting in June? No, this should provide an insight into the sentiment of the market and allow us to shape our view of what this means for markets.

For those who have studied macro, conventional wisdom tells us that in this scenario when the Fed starts to cut interest rates and the RoW holds rates, that is usually bad for the dollar since the interest rate differential between the U.S and RoW decreases or in some cases becomes negative. But we know from real history, that this isn’t always true, in fact, we can look back at 20019, or the GFC in 2007 where the Fed paused their hiking cycle before starting their IR cuts in August ‘07, the dollar appreciated in both circumstances.

Why?

It’s pretty simple, over the 135 rate cuts made from 1954 to date, the Fed only tends to cut when they perceive a need to stimulate economic activity and or prevent the U.S from experiencing a global meltdown/recession. And in such an environment, the dollar is everything.

The Dollar & Yields Outlook

As is always I’d like to see the 2-year in and around the 3.700% mark as it’s been range bound between 3.600% - 4.300%. I do see a break below 3.500% but it’s premature to start looking at how one could position themselves for such a move.

The Dollar paints a similar picture with a twist.

I’ll be sharing my thoughts on what regions post a problem for the greenback in the discord group but to provide some insight the dollar is showing some signs of relief from the aggressive short-selling that we’ve been on since March ‘23.

Equities are a market I need to slowly add into my analysis basket since the majority of my time is taken up by FX and commodities movements but I’ll be happy to add some context on equity markets.

As for now, that’s a wrap!

6:29 pm on a Friday night.

Wouldn’t have it any other way I’ll tell you that.

If you enjoyed this piece I’d love to hear from you in the comments

Consider sharing this with another macro addict?

You can’t be the only person as obsessed as you are ;)

How does one join the discord server

I look forward to your article every friday and I can tell you it is mind blowing!!! I can, but say I am getting a little understanding about investment.