The BoJ's Departure from Negative Rates: A Threat to the Carry Trade?

Delving into the reasons why the BoJ may not be so fast to move away from the accommodative policy

Hey guys,

This is going to be the beginning of many consistent reports on the Market Macro Hub channel from myself, Alfie Kerswell.

I’ve been part of MMH as an analyst since July 2023, working in the background with the main man and owner, Joe Olashugba.

I’ll be covering global macro and going in-depth into the intricacies that aren’t mainstream for everyone to read.

The goal is to deliver the most valuable and actionable reports, something you can really work with.

Drop a comment in the comment section below with some feedback, we always love to hear it.

The Japanese Yen has been in the spotlight for some time, I’m sure there’s plenty of investors who are in some drawdown trying to catch the pivot in policy.

Let’s dive into really what’s going on over there and what it’ll take to pivot.

Macro watch

It appears that Japan’s Ministry of Finance has tweaked the FX intervention strategy. USD/JPY dropped around 2% after the soft US CPI print (3% actual VS 3.1% consensus) last Thursday, considerably more than any other USD cross, and the surge in JPY futures volumes seemed consistent with FX intervention.

Japan’s top currency official Masato Kanda refused to admit that the MoF had stepped into the market but there have since been at least two reports citing internal sources that suggest intervention. It was also widely reported that Japan conducted a so-called "rate check" with traders this morning. If true, data at the end of the month will confirm this speculation. For now, given the rather unusual drop in USD/JPY, we’ll run with the assumption the MoF did intervene yesterday.

That would mark a change in Japan’s FX intervention strategy, to an extent. Remember, that at the end of April, the MoF started intervening before a Fed meeting: that round of intervention (JPY9.8tn) has proven to be largely unsuccessful beyond the very near term. Now it looks like the MoF waited to take advantage of a different USD-negative market event to boost the yen via intervention. This is a strategy that makes the intervention less noticeable (to a certain extent) and might have ended up achieving a better result in terms of JPY gains as more JPY shorts were unwound in a short period of time.

Once again assuming that the MoF did intervene in the FX market on Thursday, the sum on these interventions would be large. The estimates for 2023’s intervention were c.$23.6bn, while the total estimates for 2024 already have been c.$84.1bn.

How much more can they spend on what seems to be useless FX interventions?

Market mover

It’s everywhere, everyone has heard. Trump was nearly assassinated on Saturday, 13th July. The attempted assassination has done Trump’s party, the Republican Party, massive favours, with election predictions for Trump to be the new President of the US sky-rocketing.

It may have been clear that Trump was a favourite to win prior to Saturday, mainly due to Biden’s horrific performances in debates and mediocre behaviour. However, the emphasis on Trump regaining power can and most likely will have an impact on financial markets.

Although the gaps at market open were wiped out fairly fast across USD FX crosses, the rise in presidential election attention is proving to bring volatility to markets. There will be plenty of ways to capitalise on the presidential change, even if it is just one of many confluences to a trade in your portfolio.

With Trump likely to regain power, markets could seek the newly found optimism in the USD regardless of global trade changes such as higher tariffs on Chinese imported EV’s. However, I think most analysts will overshoot their expectations on the effect to markets from the presidential election because markets will most likely be driven by growth & monetary policy in the coming quarters. So unless there is ground-breaking change from the Republican party, there’s little chance it’ll be a trend-setter, maybe just a catalyst for more bond, stock and FX market volatility.

Japanese Yen: Opportunities for appreciation.. Or not?

The carry trade against the Japanese Yen has been dominant, for what feels like forever. We all know that yield differentials often drive the FX market which is why the Japanese Yen has lost c.53% against the US dollar since the beginning of 2021. However, a trend can only go on for so long, especially when monetary policies in the two economies will eventually diverge.

Plenty of traders will lose chunks of their portfolio trying to catch the top of the market in USD/JPY, we don’t want to be one of them.

There is more to a trend than just yield differentials when we look deeper into financial markets, especially the currency market. The BoJ will be holding a meeting with bond participants (banks, financial institutions and large market participants). The meetings will be held on July 30th and July 31st, just a few weeks from now. These meetings are aimed at determining a realistic pace of reduction in Japanese government bond purchases, the bank will then announce the reduction plan after the meeting. A reduction in these bond purchases pushes the BoJ further away from such an accommodative policy, bullish for the JPY.

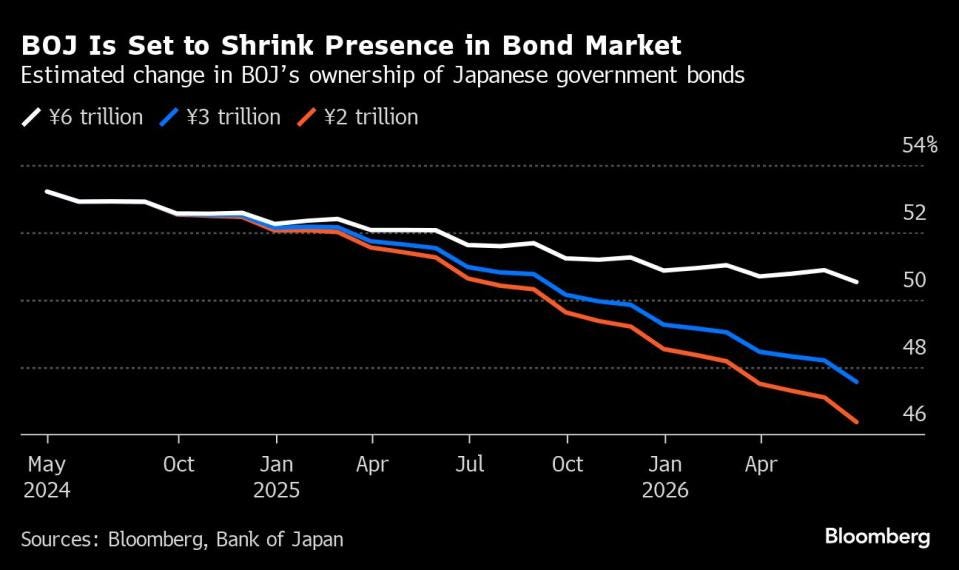

The central bank itself estimates that every percentage-point drop in its share of the bond market leads to a 2 basis point increase in 10-year yields. Assuming that the BoJ will gradually cut monthly debt purchases from the current guidance of ¥6 trillion ($38 billion) to ¥2 trillion in two years, as one strategist forecasts, yields would climb 14 basis points based on the bank’s estimate.

So now you ask, why don’t Japanese investors just seek investment abroad?

When Japanese investors buy US treasuries they must swap existing JPY for USD first, this means they would run FX risk… but they don't want that, so they hedge it. When looking at investing in 10y US treasuries after hedging USDJPY risks for 12 months, Japanese buyers see this:

US treasuries are the most expensive in decades for Japanese investors. They have been so for quarters now. Now, what happens if the Bank of Japan keeps raising interest rates making domestic bond investments more attractive for Japanese investors on top?

The yield on their government bonds will be suppressed, making it harder for the central bank to move away from the accommodative policy.

Japanese are huge exporters of capital, and changing domestic conditions can affect their behaviour in global markets. Another potential source of macro volatility to assess carefully.

There is so much hype surrounding a large pivot in monetary policy in Japan, which they began by ending negative rates on March 19th, 2024. However, there is much more to it like anything in global macro. Firstly, the BoJ needs to see a stable inflation rate, gradually increasing or at least a strong maintenance above the 2% target, looking at recent data, they aren’t close to achieving that.

For months, there was stable core inflation in Japan, but that soon took a downturn after weak growth weighed in on the economy. The reason the central bank need to wait for a steady or increasing inflation rate above 2% to raise interest rates is because if they don’t, they will run the risk of disinflation which could even turn into deflation (depending on how quickly things transmitted into the economy). A disinflationary trend could be caused by higher interest rates as the money supply will be tighter at a higher rate, limiting demand throughout the economy and dragging prices down as supply continues to exceed demand.

Growth is a major factor that the BoJ also needs to consider because as we all know, higher rates create a restrictive environment and tend to transmit quite dominantly into growth.

These figures are nowhere near stable enough to consider a tighter policy, unless the BoJ wants to cause a recession and create a larger hole for themselves. Also, raising interest rates to attract foreign direct investment, while having weak growth, is contradictory because there will not be enough perceived stability in the economy to attract the investment from overseas.

So if the central bank are waiting for stable inflation and growth to move into a higher interest rate environment, what is needed to spark growth and inflation?

Wage inflation.

If wages aren’t matching the inflation rate over time, naturally households in Japan will have less to spend, further eating into Japan’s economic growth. It’s a large spiral effect from wages which is why I believe that wage inflation will be the trigger to a restrictive policy from the Bank of Japan.

Prime Minister Fumio Kishida has held multiple meetings with business and labor leaders to encourage wage hikes. A notable one occurred in January 2024 where he emphasized the need for wage growth at smaller companies. The focus on wage growth inside Japan is a relatively recent development in Japan which is why the effects won’t be immediate.

The 2024 Shunto in February/March resulted in an average pay raise of 5.17%. This marks a significant increase compared to previous years and is the highest level in decades. More of this is needed in Japan, but the signs are positive just not immediate.

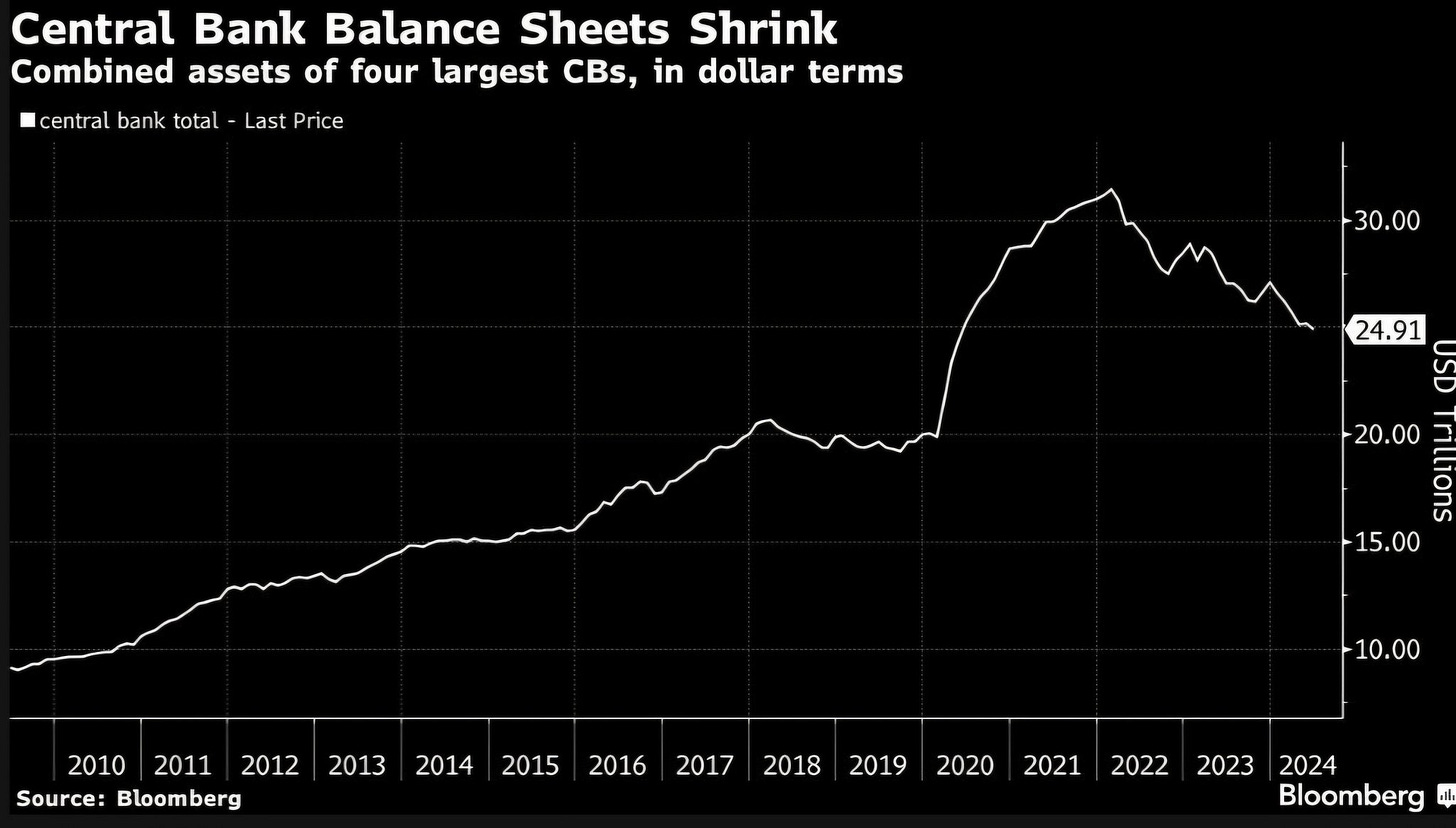

The BoJ are clearly a lag to the other G3 central banks, but have now joined them in rolling off their balance sheet. As we see in Figure 10 below, the Japanese central bank will begin tapering their balance sheet more than two years after the ECB, the Fed and the BoE began to.

Now comes the most important part for readers…

Actionable idea

I see the most risk averse, yet high yielding trade for your portfolio would be a short on the CHF/JPY. Yield differentials, perceived stability and policy expectations drive the FX market, meaning these two currencies are likely to diverge in the near future.

Summary of reasons:

BoJ moving to a restrictive policy, raising rates and eventually creating FDI through the yield offered on government bonds.

Swiss inflation is more than under control at 1.3% (YoY) and therefore causes low risk to any potential upside risk to interest rates, which also sit at a mere (in comparison to global rates) 1.25%.

SNB are known to be on the dovish side when it comes to monetary policy, bringing downside risk to interest rates in Switzerland.

Although the Swiss economy is perceived to be a safe-haven, so is the Japanese economy so there will be no downside risk to the JPY against the CHF in this part.

Yield differentials will most likely expand in favour of the JPY in the long-term, creating an easier to manage and efficient carry trade (eventually) to the downside for the CHF/JPY.

Time horizon - I will be actively looking for data to support stronger growth and inflation inside the Japanese economy and will not be looking to open any positions until that is the case. Most importantly, I’ll keep you guys updated.

That’s a wrap for this week guys!

Good read, very informative, many thanks Alfie!

Beautiful report, I loved it 😀