Hello crew!

Between hay fever from the UK mass pollen season and being in the process of moving, it hasn’t been the best start to the summer for me.

Nevertheless, it’s times like this I’d like to look back and gauge my performance on ‘off’ days, so in the words of hard rock legend Freddie Mercury, “the show must go on!”

Tariffs are back in focus, however under a different macro scope…

So let’s discuss!

Housekeeping…

In our June 22nd piece, we recommended expressing some macro view across FX, capturing both cyclical and tactical prevailing themes. If you haven’t read that, please we advise having a look, and our regulars are also welcome to have a refresher as well :)

Here’s the link…

So far, both cyclical calls have performed as we expected. GBP/MXN & EUR/CAD have gained c.3.00% and c.2.00% respectively since publication. Keeping the framework relatively simple, the former could be viewed more from a structural perspective benefiting from IDR, and the latter cyclical flows for H1 USD demise and positive reform from the Euro bloc fiscal outlook.

However, with Sterling, timing remained centered in perceptively capturing the weaker growth narrative for the UK economy as bets on rate cuts continue to pile.

We advise some profit-taking here, but maintain the broader trend should remain intact: downgraded growth outlook in the UK and tariff pressure muddying the forecast for the BoC.

Lastly, tactical positioning on USD long against the loonie didn’t seem fruitful.

“If markets truly fear things escalating here, a gap-up Sunday open on risk-off on the loonie wouldn’t come as a surprise, and in my opinion retracement filling them should be bought.”

—comments on USDCAD long recommendation

Retracements on the gap-up on Sunday opening following the Iran-Israel headlines were bought, however war/headline faders won this round. Oil drastically fell on US involvement and talks of de-escalation among all concerned parties. As is with this game, losses come with lessons/takeaway, and with one it would be valuable to point out the call for U.S. dollar losing its safe haven as just not credible enough.

Past price action has confirmed that given heightened global disorder, the greenback ultimately stands to gain, benefiting from its deep financial plumbing and reserve status.

FX & Rates

Further cementing the above view, the IMF released its quarterly COFERR (Currency Composition of Official Foreign Exchange Reserves Reporting). For readers unfamiliar, this report provides details on the composition of FX reserves held by central banks.

Because the IMF’s COFER figures are mark‑to‑market, the headline currency shares already embed Q1 price action. With that caveat in mind, three themes jump out:

Net dollar buying despite a softer greenback: the DXY slipped c.4 % in Q1, yet reserve managers added to USD holdings, lifting the dollar’s share to 57.7 % of reported reserves. In other words, valuation headwinds concealed an underlying bid for dollars.

Risk‑sensitive currencies were clipped, as allocations in AUD’s high‑beta profile lost favor amid fading global‑growth forecasts and wider funding premia. Also, managers continued to trim JPY exposure, reading the BoJ’s uncertain policy trajectory and increased JGB volatility as a drag on the currency’s safe‑haven appeal.

Swiss franc gained share at a record pace, as CHF’s weight jumped to 0.76 % from 0.18 % (the fastest single‑quarter increase on record).

It turns out that reserve managers quietly took the other side of the much‑hyped CHF/JPY short, the trade everyone expected to collapse—friends, she is UP c.11.00% YTD.

Bottom line: Official portfolios leaned further into the dollar, rotated out of pro‑cyclical carry AUD and a policy-clouded JPY, and sought refuge in the CHF.

The euro has remained under pressure, and recent price action reveals just how quickly sentiment can turn when rate differentials and fiscal dynamics reassert themselves. While EUR/USD had benefited earlier this year from its role as a diversification play, particularly during periods of U.S. political uncertainty, the currency now appears to be running rich relative to its underlying fundamentals.

Valuation models suggest the euro continues to trade well above fair value, and much of the support it previously enjoyed from Europe’s relative fiscal committment is now largely priced. This macro drop has masked growing cracks beneath the surface: widening peripheral spreads, a softening growth pulse, and increasingly divergent rate paths across developed markets.

This past week served as a timely reminder that bond vigilantes have not gone away; they are simply rotating from one region to the next. Their latest focus has turned to Europe, where fiscal pushbacks are feeding back into the sovereign complex. We saw the classic decoupling in price action: EGB yields surged higher, particularly in the periphery, while narrowing in UST/Bund yield differentials coincided with a broad sell-off in the euro across G10 FX an outcome that fits the playbook when Europe is the source of duration stress. EUR weakness was most pronounced against cyclicals like AUD and NOK, while JPY remained an exception, trading on an ‘okay’ 20y auction, although facing its own blend of idiosyncratic pressure as Japanese elections take center stage next week.

BTP/Bund spreads continue to narrow as investors reprice credit risk, with Italy gaining from fiscal discipline as France and Germany foot the bill. Markets are once again asking whether European fiscal rules, already stretched, will hold in an environment of weaker growth and larger deficits.

We remain fairly constructive on the euro: fiscal optimism is largely in the price, and positioning isn’t light. Bund yields have moved up sharply from recent lows, de-anchoring from inflation expectations, suggesting increased term premium.

U.S. Dollar Outlook: Broad-based blanket tariffs are set to take effect on August 1st: 30% on EU goods, 50% on imports from Brazil, 25% on Japan and South Korea, and 35% on Canada and 30% on Mexico.

Notably, exports from Canada and Mexico that qualify under USMCA rules will be exempt from these tariffs.

We were fortunate enough to have nailed the H1 macro outlook for the dollar. As we enter the second half of the year and tariffs are back in focus, a few notable themes now catch our attention.

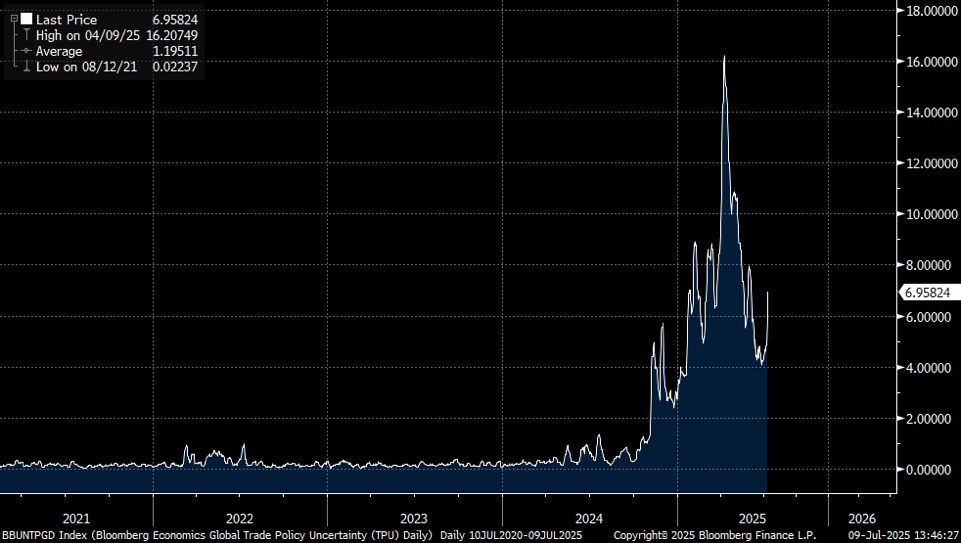

For one, the TACO trend expressed throughout the start of the year has left markets predominantly complacent in pricing in a greater uncertainty from the second wave even now when the risk appears somewhat real, with more tailored, country- and sector-specific tariffs. Equities are printing higher, and the OBBR has now passed into law, handing President Trump renewed leverage. If the administration frames the bill as a net deficit reducer, it could find itself in need of alternative capital inflows, preharps a return of the austerity mandate? Nah, we believe that ship has long sailed.

Another lense to examine this is one where deficit optics drive policy positioning once again, even if the underlying fundamentals still argue for looser fiscal conditions.

We examine the dollar in two (2) phases:

Phase I

Looking back to the start of the year, the prevailing thesis among economists, championed by Miran, now serving as Chair of the CEA was that the ccy of exporting nations would weaken against the U.S. dollar, thereby cushioning the impact of tariffs on U.S. consumers. In hindsight, that assumption proved misguided. Instead, the aggressive and erratic rollout of first wave tariff figures only galvanized many of its trade partners to enact proactive fiscal reforms to defend their economic interests.

Markets quickly front-ran these developments, interpreting them as structurally positive for the respective ccy, triggering capital inflows and driving FX appreciation, not depreciation as suggested.

The dollar, by contrast, sold off following Liberation Day under the weight of dovish repricing. Markets moved to price in a full percentage point of Fed rate cuts, anticipating a drag on growth.

Which brings us to…

Phase II

Since then, the landscape has shifted. Trade agreements with major players such as China & the UK have been reached; recently, Vietnam was added to the list, while the broader macro backdrop has remained relatively resilient, removing any near-term urgency for Fed policy intervention as we experience future bear flattening across the curve.

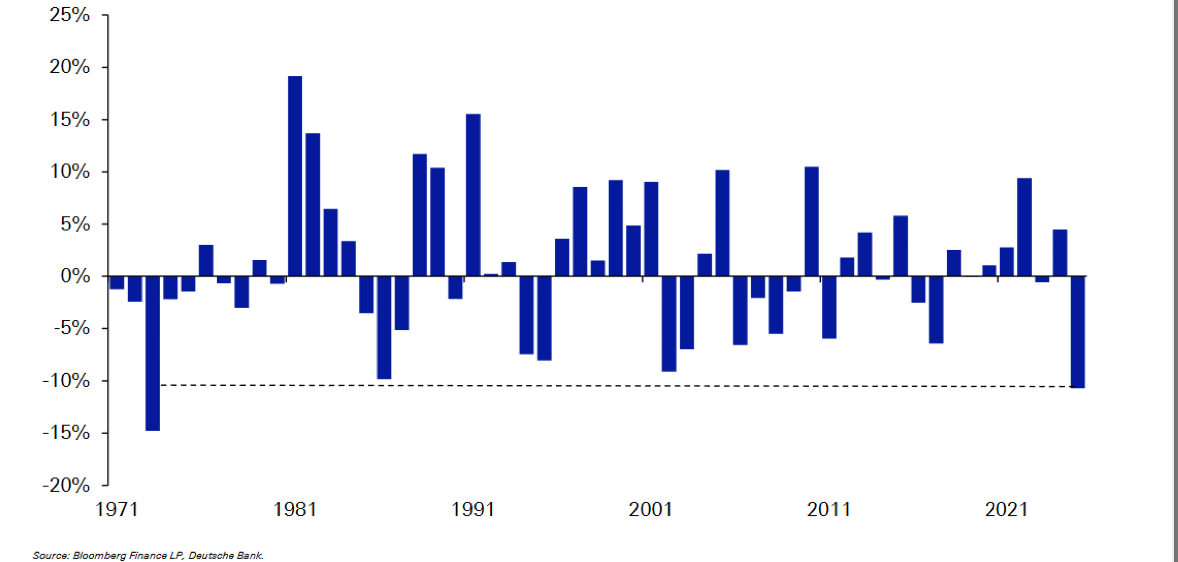

As of writing, headlines suggest Europe may be preparing retaliatory measures. This is consistent with the typical dynamic of tariffs: they tend to raise prices in surplus countries while exporting deflation from the source economy. The chart above reflects this mechanism, though the timing of pass-through effects remains uncertain. This lag is a key hurdle. We’re already observing early signs of it most notably in sharply falling prices for Japanese autos exported to the U.S. relative to the RoW.

However, if history is a guide, companies end up passing costs and price transmission tends to follow with a delay. Against this backdrop, we expect the Fed to maintain a wait-and-see stance, with rate-cut bets continuing to be pared back unless a clear deterioration emerges in labor market data, which has yet to materialize in headline prints. September’s FOMC meeting will likely serve as a reaffirmation of this policy inertia.

Furthermore, we reject the notion that markets have become “desensitized” to tariff developments. Instead, we now view this as dollar positive as suggested by recent price action across FX, as USD continues to gain against traditional safe havens such as the EUR, JPY, and CHF.

In summary, we think in the near term the dollar will trade in close correlation with tariff headlines; however, in the longer run, RoW stands to benefit from adopted structural reform heading into H1’26 as the Fed gears to resume policy easing.