Hey guys,

What a week it has been for me in the markets, some great ideas finally closed out in some good profit.

If that wasn’t enough to keep me entertained, Musk and Trump had me covered.

Who would’ve thought that type of online spat would’ve played out? Truly crazy times.

At this point in time, anything is possible.

Let’s unpack the most important things in markets right now!

Macro watch

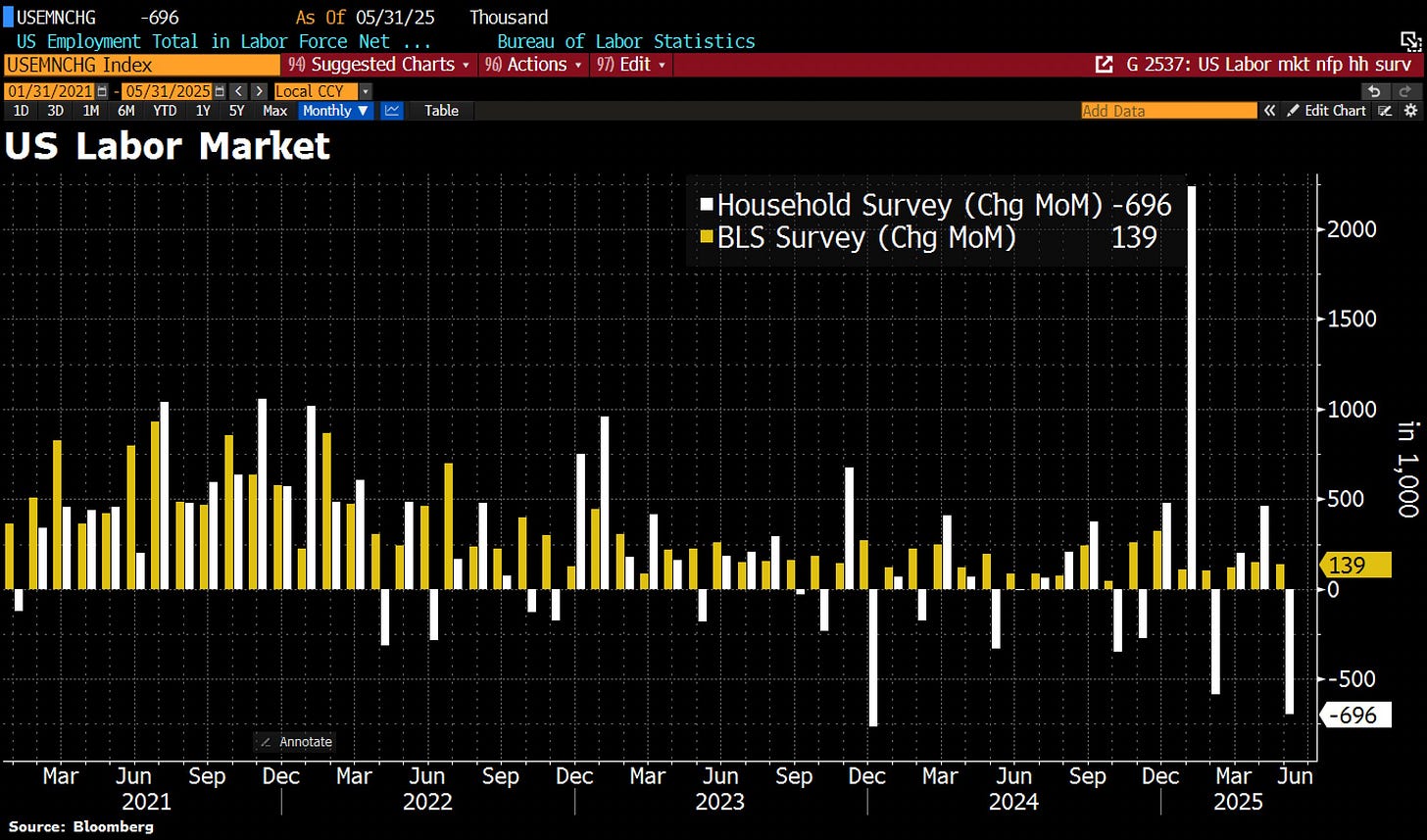

NFP was another great example of how overblown recession odds are. Jobs data came in hot (139k vs 126k) while unemployment held steady at 4.2%.

Now I’m not ignoring the fact that jobs data isn’t necessarily on the up, but what I’m focused on is the tight and consistent period we are in of jobs and openings. Remember, a recession is heavily identifiable through the jobs market and we’re not there yet. I’m not saying we won’t enter a period where jobs will be crushed and unemployment will be sky high, what I’m explaining is that we’re just not near that time yet.

The labor market acts as a stimulus, like QE (don’t take this literally). More jobs, more money in consumer pockets and ultimately more spending. We’re not just seeing this trend in the US, but across G4. We’re seeing these data points (NFP, inflation, rates) act as the catalyst for some normalisation. Q1 was a unique period of time, markets are normalising past that but catalysts are the cause for moves. The way to make money is this market is to be early, if the idea on a no recession is correct then… We’re early.

“No recession” thesis

So the jobs market is confirming the beginning of what should be some unwinding in recession expectations, we’re seeing this through job openings, unemployment and NFP.

But what else?

If we know that the labor market can stimulate the economy to a degree where consumer spending accelerates, then the Fed are truly falling behind the curve. Just take a look at the 2Y and 10Y below, remembering that the Fed control the short-end while growth and inflation expectations control the long-end.

But why does this matter?

We see how the unwinding in rate expectations on Z5 (year-end rate expectations) went from c.125bp to around c.50bp and large normalisation hit markets, with risk-on. So my point is that I think there could be a strong case that these expectations realise into the market and we start seeing that inflation is still persistent (indices higher). I don’t think the Z5 will drop heavily because of current pricing, I think we’re likely to stay range bound considering that 50bp seems fair. A pause is already priced in for June and given the possibility that jobs and inflation data can stay strong, the market can play catch up.

If the Fed’s forward guidance falls behind the curve enough (which it seems to be), then risk assets can go a whole lot higher. This is because the 10Y is representing an acceleration in inflation, a nice steepening yield curve, showing what could be good for the receivers of consumer spending.

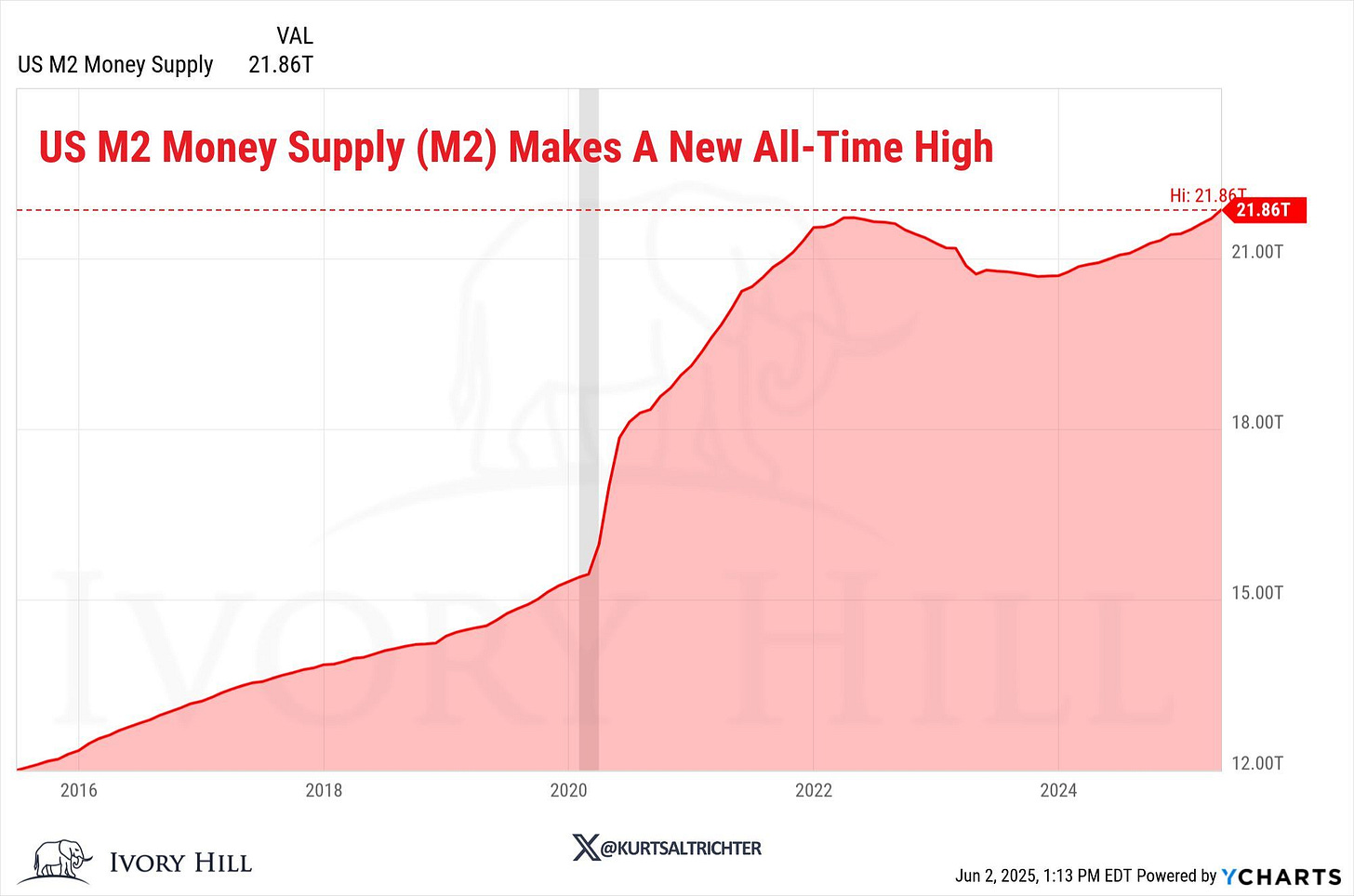

It adds to our thesis but isn’t a driver, but it’s interesting how the supply of M2 is increasing…

It’s never been a large non-recessionary sign but it matters, there’s more money being pumped into the system, even through credit creation via banks. Banks have the real data of defaults on loans, why would credit creation increase if there was a recession so close? (ignoring the GFC because that was driven by mortgages rather than general loans etc).

The issue for the Fed is this, if jobs and inflation data continues printing resilient, there is no option to cut. What makes it worse is that if inflationary pressures rise (through energy), they’re even more cooked. This is where we ditch traditional thinking where higher for longer means a flight to safety, you need to understand that the macro context is screaming inflationary pressures rather than super negative growth and disinflation.

Imagine if this now rips higher..

(Chart from AlphaPicks)

Bonds have taken a hit for such a while, there is just simply no value in them right now. a crucial lesson on why it’s important to not be so strict on following classic 101 rules like: rates up = bonds up / rates down = risk-on. Do you not think that if a recession were the highly likely outcomes, indexes would be making lows rather than continuously pumping higher, look back at previous examples.

It’s also interesting to see how the market is moving on tariff news, a headline about Trump-Xi call moved markets (particularly small-caps) so now imagine when we get some real unwinding of tariff fears and more normalisation.

Now, lets look at what is happening elsewhere which feeds the thesis.

The ECB cut rates 25bp to 2% and is likely to be the last for a while after they cut rates 8 consecutive times and now have the policy stance of data dependency, the two words I heard for way too long. Considering the market is pricing in a terminal rate of 1.5%, it seems fair that a few pauses are on the cards. They are well ahead of the Fed in cuts but they have a tai-wind to inflation as mentioned above, energy. Their headline inflation is 1.9% and services are cooling but if energy does rip then they’re in a tough place, it’s just simply too dangerous to cut again anytime soon.

If growth cracks through a bad deal with the US, then I could maybe say that the terminal rate is 1% (market mis-priced) but I don’t think this is the base case at the minute. An example of how normal trends are decoupling is the Euro, we’re seeing large Euro pumps even on the back of rate cuts, ditch traditional thinking!

You wouldn’t think that this is a chart from a currency whose central bank is cutting, would you?

Ok how does this tie into tie into the “no recession” thesis?

If the eurozone (a large contributor to global growth) has rates at a place where some stability can be seen also while growth is moderate and inflationary pressures remain then consumer spending can spur here too.

Positioning

Indices seem set for continued upside, but more mild than small-cap indices

Neutral on bonds, I think that it’ll be tough for them to rip much lower considering where pricing is for rates

Long AUD on China-US deal, rate differentials and inflationary story

As laid out in January, shorting the Dollar on pullbacks

This is why it’s hard to be short on bonds - ZN pricing seems fair:

That’s all for this week guys!

Long AUDJPY looks pretty good!

Inverse H&S on the daily, plus break of resistance trendline (with also retest completed)

Tomorrow the US and China meet for the second round of trade talks, and definitely Trump will try to spit it positively (as he already has done) one way or another.

Solid trade.