Hey guys,

Yes, two reports in one week for the first time in a while.

We will aim to do two per week from now on (one from me and one from Emmanuel).

This report is a part two from Emmanuel, I know many of you enjoyed the first one.

Take notes!

Exchange Rates—The Market Price of Currencies

In financial markets, exchange rates are treated as fast-moving tickers reflecting capital flow dynamics, risk sentiment, and policy divergence.

In layman’s terms, the exchange rate is like the price tag on a currency—how much one unit of a currency is worth in terms of another. For example, if the EUR/USD is quoted at 1.1200, it means 1€ = 1.12$. Just like oil prices reflect supply and demand in energy markets, exchange rates reflect the market’s view on interest rate differences, inflation trends, growth expectations, and even political stability between two economies. If you're travelling, buying goods from abroad, or investing overseas, you're participating in the FX market.

The world’s largest market for a reason.

Fixed, Floating & Managed

By now, we should be getting the gist—exchange rates are largely determined through market discovery, shaped by economic inputs interacting with each other. For instance, if a country’s nominal GDP grows consistently faster than another’s, its currency may strengthen in relative terms.

This describes a floating exchange rate, which is adopted by around 30–35% of countries, mostly developed market majors like the USD, EUR, GBP, CAD, AUD, etc. Here, value is determined by supply and demand.

This system provides a relatively clean read of economic fundamentals. However, its openness also means floating currencies are prone to large swings, especially in response to monetary or fiscal shocks. For event-driven traders, understanding this dynamic is essential. These markets offer increased volatility and opportunity.

How a government or central bank manages its exchange rate is called exchange rate policy. This regime affects how much influence market forces versus government decisions have on currency movements. For macro traders, understanding these policies provides perspective on potential volatility, gauges central bank reaction function, and asymmetries where policy constraints might eventually snap under pressure.

These reasons will become clearer as we continue.

The policy spectrum ranges from free-floating to hard pegs. In a fixed exchange rate regime, as the name suggests, a country pegs its currency to another (usually the USD) or to a basket of currencies. The whole premise here is anchored on policy commitment, where the central bank adheres to maintaining its exchange rate within a narrow band.

A classic example is the Hong Kong Dollar (HKD), pegged within a 7.75–7.85 range against the USD. Notably, in response to dollar depreciation YTD, the Hong Kong Monetary Authority (HKMA) intervened in May 2024 for the first time in over four years, selling HK$46.54 billion to defend the peg’s lower bound. Economies with fixed regimes are typically highly dependent on trade flows. Hong Kong, as a re-export hub for mainland China, is no exception. In such cases, monetary stability is paramount to curb FX volatility that could disrupt external balances.

Honourable mentions go to oil-exporting nations like Saudi Arabia and the UAE, which peg their currencies at 3.75 and 3.67 to the USD, respectively. This ensures price stability for energy revenues and predictability in trade. But the trade-off is reduced policy flexibility.

When the anchor currency hikes rates, pegged economies may be forced to follow—even if domestic conditions don't warrant tightening.

In between lies the managed float, where central banks intervene episodically. The Bank of Japan (BoJ), for example, doesn’t operate a peg, but has repeatedly stepped into the market when JPY volatility runs too hot.

Understanding exchange rate regimes leads naturally to the Impossible Trinity: a country cannot simultaneously maintain a fixed exchange rate, free capital mobility, and independent monetary policy. Only two of the three are possible. Ignore this constraint at your peril. The 1990s Asian Financial Crisis is a textbook reference of pegs snapping under macro stresswhen East Asian countries like Taiwan were forced to devalue after being unable to match the Fed’s rate hikes, leading to massive capital flight.

We’ve also seen such in developed markets, we can't discuss extreme FX moves without referencing the infamous George Soros, the man who broke the Bank of England in 1992. The UK attempted a semi-fixed exchange rate as part of the European Exchange Rate Mechanism (ERM), shadowing the Deutsche Mark. But the fundamentals didn’t align: the UK had higher inflation, weaker growth, and needed lower rates. To defend the pound, it had to mirror Germany’s higher rates. Despite efforts to defend the peg, hiking rates and burning FX reserves, the UK was forced to exit the ERM. The pound collapsed by nearly c.20%. Soros reportedly made over $1 billion.

Another casualty of the Trinity. When a peg becomes misaligned with domestic fundamentals, it’s a recipe for disaster.

Ebbs & Flows— Debt Dynamic, Correlations & Safe Havens

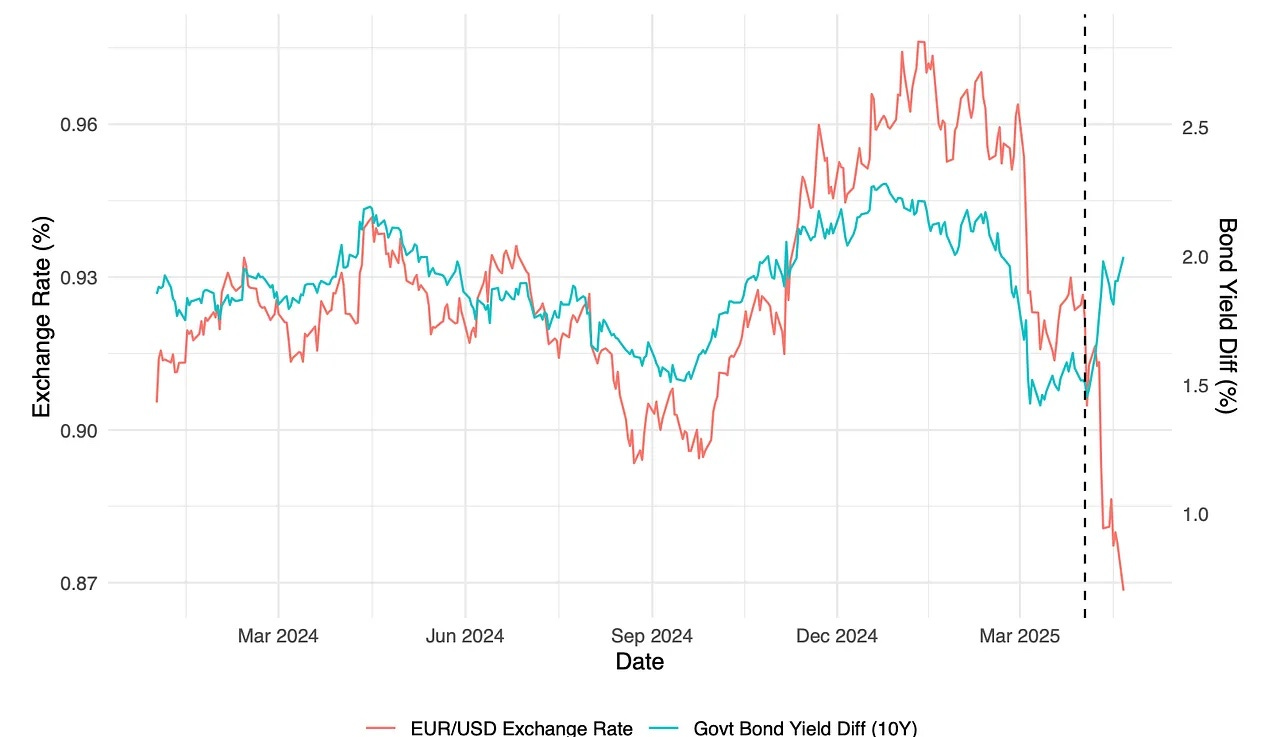

As we’ve stated earlier in part 1 of this CCY series majority of the moves across FX are grounded on IRD (Interest Rate Differentials), but if you’ve solely relied on that since the start of Q2, we can agree it hasn't produced the clearest of signals.

Let’s break it down.

Firstly, it’s important to lay some groundwork.

Correlations in FX markets are dynamic reflections of global macro flows, not fixed relationships. While currencies don't move in isolation, their pairings often reveal deeper risk sentiment and cross-asset linkages. In regimes dominated by risk appetite, so-called pro-cyclical currencies, those tied to global growth and commodity cycles proxies like AUD, NZD & CAD or even high carry, such as MXN & BRL, tend to rise and fall in unison.

Conversely, safe-haven currencies like the JPY, CHF, and the USD often outperform during periods of stress. But these relationships aren't static; they evolve with central bank regimes, geopolitical pressures, and structural imbalances. Traders relying solely on historical correlation can find themselves blindsided when a regime shift reorders the global playbook.

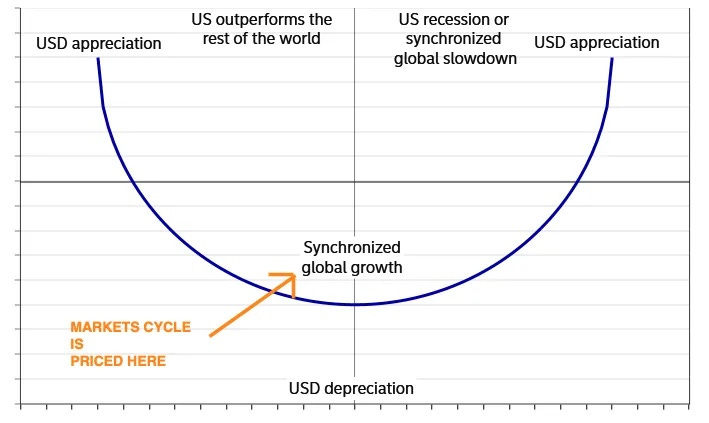

Today, we’re seeing a regime shift: the U.S. dollar’s status as the global reserve currency no longer offers the reflexive safe haven. Despite still holding a positive IRD over its G10 peers, the USD is no longer the clean beneficiary of market stress. This signals a regime shift in how investors assess U.S. assets—the fundamentals are being questioned.

One key area of concern is fiscal credibility. Why is the deficit increase, which was welcomed by the German economy, sending warnings to the US market reminiscent of the 2022 Liz Truss market turmoil? This divergence is about perceived fiscal discipline. The U.S. is running a fiscal deficit near -7% of GDP, at a time of full employment and positive growth. Recent downgrades by Moody’s and lingering concerns about the structural impact of the proposed tax bill set to pass in the House before Memorial Day have added to the sense that the U.S. is becoming fiscally unanchored.

The decoupling between EUR/USD and yield spreads reflects this shift. Despite higher U.S. yields, the dollar has weakened. Investors are diversifying away from USD, seeing rising yields as a credit risk, not a growth signal.

The chart above largely sums it up. Let’s note this is not an absolute direction in spot terms of the EUR/USD but rather depicts tracking of this FX pair movement in lock step with change in yield spread between both economies, and as the chart points out, that link has now been broken.

The Dollar Smile theory helps contextualise this. The USD rallies in two extremes: when U.S. growth is exceptional, or during a global crisis. In the middle: subpar U.S. growthexpectation, fiscal risks, and better global alternatives—the dollar weakens. It’s a blow from both directs, really with the Euro bloc taking proactive measures on fiscal expansion and making effort to rekindle domestic demand from progressive G7 trade talks has created tailwind for the EUR while USD continues to face policy headwinds— It’s all about perception at the moment and Europe’s cards score higher.

For the current trend to persist, we’d likely need:

• A material softening in U.S. domestic data,

• A clear dovish turn from the Fed.

So far, neither has decisively occurred. But it’s clear markets aren’t following central bank signalling. Investors are focused on fiscal risks, putting more weight on UST demand. A weak 20Y UST auction this week validates that. Until the White House addresses its fiscal position, the greenback bears the brunt.

Putting it all together

1. Start with Macro Regime

Reflation— Long EMFX, pro-cyclicals (AUD, MXN)

Stagflation— Risk-off bias, harder to gauge as CB are caught in a policy trap

Goldilocks— Carry trades outperform

Deflation — Long safe havens, short cyclicals

2. Monetary Policy as Anchor FX, especially in G10 (focus there)

CB tone, forward guidance, and OIS pricing.

Trade the surprise differential, not just the headline rate.

Long under-priced hawks, short overvalued doves.

3. Positioning & Event Catalysts—Macro defines direction, but timing comes from positioning & catalysts.

COT reports, real money vs. fast money flows h/l crowded trades.

Catalysts: CB meetings, CPI/NFP, elections, geopolitical risk.

Pre-positioning plus reaction function provides the technical set up.

4. Lastly, the checklist order: What have current market moves been priced by? » How do central banks diverge?

What’s priced in vs. guidance? »Who’s crowded, and where’s the pain trade? » Is there an upcoming event to catalyse the move?